Interview Guides

Work as a Financial Engineer in top investment banks, hedge funds, consulting companies is a dream of many

Interview Guides - Coming Soon

Credit Risk Modeling and Derivatives

Key aspects of financial analysis and risk management.

Market Risk

Evaluating and managing potential losses arising from market fluctuations.

Portfolio Theory & Optimization

Maximizing returns while managing risk in investment portfolios.

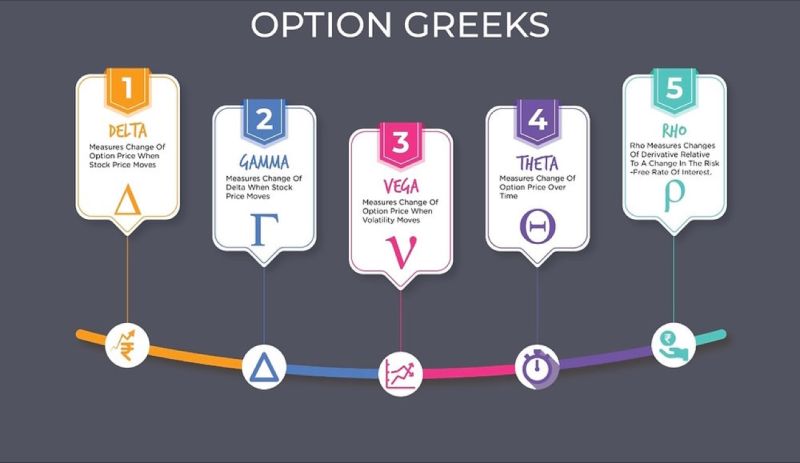

Options & Derivatives

Financial instruments for risk management and speculation.

Fixed Income & Structured Products

Investment securities with predictable returns and customized features.

Computational Finance

Applying advanced math and comp. techniques to analyze financial markets and investments.

Model Validation (Process & Challenges)

The process and challenges of assessing the accuracy and reliability of financial models.

Monte Carlo Simulation

Utilizing random sampling to estimate and analyze complex outcomes in financial scenarios.

Stochastic Modeling

Employing probability and randomness to create mathematical models for uncertain systems or events.

Programming in Python

Utilizing a versatile and popular language for various applications and tasks.

Machine Learning

Leveraging algorithms to enable systems to learn and improve from data without explicit programming.

Big Data in Finance

Utilizing large-scale data analytics to gain valuable insights and improve financial decision-making.

Famous Quant Books

"Options, Futures, and Other Derivatives" - John C. Hull

"Bond Markets, Analysis, and Strategies" - Frank J. Fabozzi

"Market Risk Analysis: Practical Financial Econometrics" - Carol Alexander

"Risk Management and Financial Institution" - John C. Hull

"Market Risk Analysis: Quantitative Methods in Finance" - Carol Alexander

"Advances in Financial Machine Learning" - Marcos Lopez De Prado

"A Primer for Mathematics of Financial Engineering" - Dan Stefanica

"Monte Carlo Methods in Financial Engineering" - Paul Glasserman